Debits And Credit: A Beginner’s Guide

August 23, 2024

Maintain a watch out for fraudulent expenses and make all of your funds on time. Fortunately, federal governments have put stronger shopper safety laws in place to guard cardholders. This graded 40-question check measures your understanding of the subject Debits and Credits. Discover which ideas you have to examine additional and improve your long-term retention. This graded 20-question check measures your understanding of the subject Debits and Credit. This graded 30-question check measures your understanding of the subject Debits and Credits.

Reap The Advantages Of Accounts That Already Exist

After all, you discovered that debiting the Money account within the common ledger increases its stability, yet your bank says it’s crediting your checking account to increase its balance. Equally, you realized that crediting the Cash account in the common ledger reduces its balance, but your bank says it’s debiting your checking account to reduce its stability. Each Time money is acquired, the asset account Money is debited and another account will must be credited. Since the service was carried out concurrently the money was acquired, the income account Service Revenues is credited, thus growing its account stability.

Debits And Credits

The more you owe, the larger the value within the bank loan bucket goes to be. Your “furniture” bucket, which represents the entire worth of all the furnishings your organization owns, additionally modifications. Get free guides, articles, tools and calculators that will assist you navigate the financial facet of your corporation with ease. The magic occurs when our intuitive software and actual, human help come collectively.

Half of that system is the usage of debits and credit to publish enterprise transactions. Instead of spending time on manual journal entries and finding errors, use accounting software like QuickBooks. It connects directly to your bank feed to precisely import each transaction, providing you with more time to run your corporation and make decisions based on dependable, real-time monetary data. It also can help you reconcile your financial institution accounts, generate monetary reports, and maintain monitor of bills with out all of the handbook work.

- The book value of a company equal to the recorded quantities of assets minus the recorded amounts of liabilities.

- As A Outcome Of single-entry bookkeeping is a cash system, which merely data incoming and outgoing cash in a single ledger, it’s not used very often by skilled accountants or bookkeepers.

- Free accounting instruments and templates to help velocity up and simplify workflows.

- Implementing accounting software may help make sure that every journal entry you submit keeps the formulation and complete debits and credit in stability.

An instance from our on a regular basis lives includes utilizing a bank card to purchase gadgets or cover expenses for which we lack funds. The Place the asset refers to the resources owned by a company and has a financial benefit. For example, intellectual property, company automotive debits and credit accountingtools, and a lot of more.

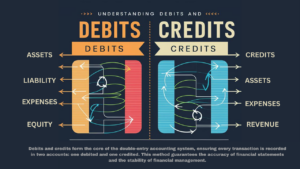

For instance, if a enterprise takes out a loan to buy new equipment, the firm would enter a debit in its gear account as a result of it now owns a brand new asset. The distinction between debits and credit lies in how they affect your numerous business accounts. Your goal with credit and debits is to keep your numerous accounts in balance. When you complete a transaction with considered one of these playing cards, you make a payment out of your checking account.

You’ll record a proof below the journal entry so as to rapidly decide the purpose of the entry. The debit will increase the gear account, and the money account is decreased with a credit score. Asset accounts, including cash and gear, are increased with a debit steadiness.

As A Result Of the hire cost will be used up within the current period (the month of June) it is considered to be an expense, and Rent Expense is debited. If the fee was made on June 1 for a future month (for instance, July) the debit would go to the asset account Pay As You Go Lease. Revenues and positive aspects are recorded in accounts corresponding to Gross Sales, Service Revenues, Curiosity Revenues (or Curiosity Income), and Acquire on Sale of Belongings. These accounts normally have credit score balances which are increased with a credit entry.

When your small business does anything—buy furnishings, take out a loan, spend cash on research and development—the amount of money within the buckets adjustments. Our intuitive software automates the busywork with powerful instruments and features designed that will help you simplify your financial administration and make informed enterprise choices. Notice that this means the bond issuance makes no impression on equity. When stock gadgets are acquired or produced at varying costs, the corporate will want to make an assumption on the method to flow the changing prices. The amount of principal due on a proper written promise to pay. The accounting time period meaning an entry might be made on the left side of an account.

With this method, you post debits on the left aspect of a journal and credit on the best. The whole dollar quantity posted to every debit account needs to be equal to the whole dollar amount of credits. A contra income account that reports the reductions allowed by the seller if the client pays the quantity owed inside a specified time period. For instance, phrases of “1/10, n/30” signifies that the customer can deduct 1% of the quantity owed if the customer pays the quantity owed within 10 days. As a contra income account, sales low cost may have a debit stability and is subtracted from sales (along with gross sales returns and allowances) to arrive at internet gross sales.

For corporations in the enterprise of lending money, Curiosity Revenues are reported in the working part of the multiple-step earnings assertion. The preliminary problem is understanding which account may have the debit entry and which account will have the credit score entry. Before we clarify and illustrate the debits and credits in accounting and bookkeeping, we’ll focus on the accounts in which the debits and credits might be entered or posted. Debits and credits are terms utilized by bookkeepers and accountants when recording transactions within the accounting records. The amount in every transaction must be entered in a single account as a debit (left side https://www.personal-accounting.org/ of the account) and in one other account as a credit score (right facet of the account). This double-entry system supplies accuracy within the accounting data and monetary statements.