The Ultimate Guide to Forex Trading Accounts 1507925954

October 27, 2025

The Ultimate Guide to Forex Trading Accounts

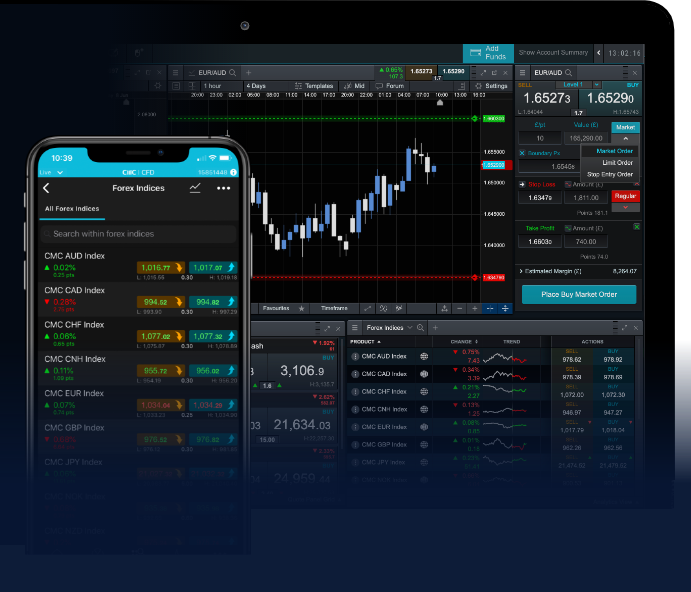

In the world of Forex trading, understanding the mechanics behind a forex trading account Trading Brokers account is essential for anyone looking to enter and succeed in the vast market of foreign exchange currency trading. A Forex trading account serves as your gateway to buying and selling currency pairs, managing your investments, and leveraging opportunities in a global marketplace. This comprehensive guide will uncover the layers of Forex trading accounts, providing insights into their types, how to open one, and tips for maximizing your trading experience.

What is a Forex Trading Account?

A Forex trading account is a financial account that allows you to participate in currency trading through a broker. It facilitates the buying and selling of currency pairs, providing you with a platform to manage your trades and track your profits and losses. There are several types of Forex accounts, each designed to meet different trading needs and levels of experience.

Types of Forex Trading Accounts

Forex trading accounts can generally be classified into the following types:

- Standard Account: This is the most common type of Forex trading account, typically requiring a minimum deposit and offering a range of trading tools and features ideal for retail traders.

- Mini Account: A mini account allows traders to work with smaller lots compared to a standard account, making it a suitable option for beginners who wish to explore Forex trading without risking large amounts of capital.

- Micro Account: Even smaller than mini accounts, micro accounts allow for micro-lot trading, providing a risk-controlled environment for new traders.

- ECN Account: An Electronic Communication Network (ECN) account connects traders directly to other market participants. This type of account typically offers tighter spreads and is used by more experienced Forex traders.

- Islamic Account: Islamic accounts are designed for Muslim traders who wish to comply with Sharia law. They do not pay or receive interest on overnight positions.

How to Open a Forex Trading Account

Opening a Forex trading account involves a few key steps:

- Choose a Reputable Broker: Research different Forex brokers to find one that suits your needs in terms of regulation, trading platform, fees, and customer support.

- Complete the Application: Once you’ve chosen a broker, visit their website and fill out the application form. This typically requires personal details, trading experience, and financial information.

- Verify Your Identity: Most brokers will require you to submit identification documents, such as a passport or utility bill, to verify your identity and address.

- Fund Your Account: After your account is verified, you can deposit funds using various payment methods, like credit card, bank transfer, or e-wallets.

- Download Trading Platform: Finally, you will need to download the broker’s trading platform software, such as MetaTrader 4, to start trading.

Understanding Margin and Leverage

One of the critical features of a Forex trading account is the ability to use margin and leverage. Margin refers to the amount of money you need to deposit to open a position, while leverage enables you to control a larger position with a smaller amount of capital. For example, with 100:1 leverage, you can control $100,000 in currency with a deposit of just $1,000. While leverage can amplify your profits, it also increases the potential for losses, so it’s crucial to use it wisely.

Risk Management in Forex Trading

Effective risk management is vital for successful trading in Forex. Here are some strategies to help you manage your risks effectively:

- Set Stop-Loss Orders: Always place stop-loss orders to limit potential losses on your trades.

- Use Proper Position Sizing: Determine the right size for your positions based on your overall trading capital and risk tolerance.

- Diversify Your Trades: Avoid putting all your capital in a single trade or currency pair; diversify to spread the risk.

- Stay Informed: Keep abreast of market news and events that can impact currency prices.

Tips for Successful Forex Trading

Here are some tips to enhance your Forex trading experience:

- Develop a Trading Plan: A solid trading plan helps you stay focused, outlines your goals, and establishes your strategy.

- Practice with a Demo Account: Before risking real money, use a demo account to practice your trading strategies and familiarize yourself with the platform.

- Keep Emotions in Check: Emotional trading often leads to poor decisions; stick to your trading plan and maintain discipline.

- Continuously Learn: The Forex market is ever-evolving, so stay updated with new strategies, techniques, and market analysis.

Conclusion

A Forex trading account is your key to participating in the global currency market. Understanding the types of accounts available, how to open one, and proper risk management strategies will significantly enhance your trading experience. Remember to stay disciplined, continuously learn, and refine your strategies to succeed in this dynamic trading environment. Whether you are a novice or an experienced trader, mastering the subtleties of Forex trading accounts is essential for achieving your financial goals.